8 Simple Techniques For Feie Calculator

Wiki Article

The Ultimate Guide To Feie Calculator

Table of ContentsNot known Details About Feie Calculator Feie Calculator - An OverviewFacts About Feie Calculator RevealedFacts About Feie Calculator RevealedFeie Calculator for BeginnersNot known Incorrect Statements About Feie Calculator The Definitive Guide to Feie Calculator

If he 'd frequently taken a trip, he would certainly instead finish Component III, listing the 12-month duration he satisfied the Physical Existence Examination and his travel history. Step 3: Reporting Foreign Income (Part IV): Mark gained 4,500 per month (54,000 annually).Mark calculates the currency exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his income (54,000 1.10 = $59,400). Since he stayed in Germany all year, the portion of time he stayed abroad during the tax obligation is 100% and he enters $59,400 as his FEIE. Ultimately, Mark reports overall salaries on his Kind 1040 and goes into the FEIE as a negative amount on time 1, Line 8d, lowering his taxable income.

Picking the FEIE when it's not the very best option: The FEIE may not be excellent if you have a high unearned earnings, earn greater than the exclusion limit, or reside in a high-tax nation where the Foreign Tax Credit History (FTC) might be a lot more advantageous. The Foreign Tax Obligation Credit History (FTC) is a tax reduction strategy typically utilized along with the FEIE.

The Basic Principles Of Feie Calculator

deportees to counter their U.S. tax financial debt with international income tax obligations paid on a dollar-for-dollar reduction basis. This indicates that in high-tax countries, the FTC can frequently eliminate united state tax debt entirely. Nonetheless, the FTC has limitations on qualified taxes and the maximum case amount: Qualified taxes: Only revenue taxes (or taxes instead of earnings tax obligations) paid to international governments are qualified.tax responsibility on your foreign earnings. If the international tax obligations you paid exceed this limitation, the excess international tax can usually be continued for approximately 10 years or returned one year (using an amended return). Preserving exact records of foreign revenue and tax obligations paid is therefore essential to calculating the correct FTC and preserving tax obligation conformity.

migrants to decrease their tax obligation liabilities. For example, if a united state taxpayer has $250,000 in foreign-earned revenue, they can leave out approximately $130,000 using the FEIE (2025 ). The remaining $120,000 may after that undergo taxes, yet the U.S. taxpayer can potentially apply the Foreign Tax Credit scores to counter the taxes paid to the foreign nation.

Not known Details About Feie Calculator

He marketed his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his spouse to help accomplish the Bona Fide Residency Test. Neil aims out that acquiring building abroad can be testing without very first experiencing the place."It's something that individuals require to be really thorough about," he claims, and suggests expats to be cautious of common blunders, such as overstaying in the United state

Neil is careful to cautious to Tension tax authorities that "I'm not conducting any performing any type of Service. The United state is one of the couple of countries that taxes its people regardless of where they live, indicating that also if a deportee has no income from United state

Not known Facts About Feie Calculator

tax return. "The Foreign Tax obligation Credit scores allows individuals working in high-tax nations like the UK to offset their U.S. tax liability by the quantity they have actually already paid in tax obligations abroad," claims Lewis.The prospect of reduced living expenses can be alluring, yet it commonly includes compromises that aren't quickly obvious - https://site-mtfua8qr1.godaddysites.com/. Housing, for instance, can be more budget friendly in some nations, however this can suggest jeopardizing on facilities, security, or accessibility to dependable energies and solutions. Low-cost residential properties could be situated in locations with inconsistent internet, limited public transport, or unstable medical care facilitiesfactors that can substantially impact your daily life

Below are several of one of the most regularly asked concerns about the FEIE and various other exclusions The Foreign Earned Income Exemption (FEIE) enables united state taxpayers to exclude up to $130,000 of foreign-earned income from federal income tax obligation, minimizing their U.S. tax obligation obligation. To certify for FEIE, you need to satisfy either the Physical Existence Examination (330 days abroad) or the Authentic Residence Test (verify your primary house in a foreign nation for a whole tax obligation year).

The Physical Presence Examination requires you to be outside the united state for 330 days within a 12-month period. The Physical Presence Test likewise calls for united state taxpayers to have both a foreign income and a foreign tax obligation home. A tax obligation home is specified as your prime place for service or work, no matter of your family's home. https://www.edocr.com/v/baoqoy8v/feiecalcu/feie-calculator.

Feie Calculator Things To Know Before You Buy

An income tax treaty in between the united state and an additional nation can aid prevent double taxation. While the Foreign Earned Income Exclusion reduces gross income, a treaty might give added advantages for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a called for declaring for united state residents with over $10,000 in international monetary accounts.

The foreign made income exemptions, sometimes described as the Sec. 911 exclusions, omit tax on earnings gained from functioning abroad. The exemptions comprise 2 components - an earnings exemption and a real estate exemption. The adhering to Frequently asked questions talk about the advantage of the exclusions consisting of when both partners are expats in a basic manner.

Some Known Questions About Feie Calculator.

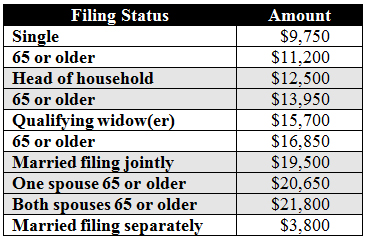

The income exclusion is now indexed for rising cost of living. The maximum annual income exclusion is $130,000 for 2025. The tax obligation advantage excludes the income from tax at lower tax obligation prices. Formerly, the hop over to here exemptions "came off the top" minimizing income topic to tax obligation at the leading tax obligation prices. The exclusions may or may not decrease earnings made use of for various other purposes, such as IRA limits, child credit scores, personal exemptions, etc.These exclusions do not excuse the incomes from United States tax however simply offer a tax reduction. Keep in mind that a bachelor functioning abroad for all of 2025 who earned about $145,000 with no other income will have gross income minimized to absolutely no - efficiently the exact same solution as being "tax totally free." The exclusions are computed every day.

If you attended business conferences or seminars in the US while living abroad, earnings for those days can not be left out. Your earnings can be paid in the US or abroad. Your employer's area or the location where wages are paid are not factors in certifying for the exclusions. Taxes for American Expats. No. For United States tax it does not matter where you maintain your funds - you are taxable on your globally earnings as an US individual.

Report this wiki page